st louis county personal property tax rate

The median property tax also known as real estate tax in St. Louis County Minnesota is 1102 per year for a home worth the median value of 140400.

Action Plan For Walking And Biking St Louis County Website

See Results in Minutes.

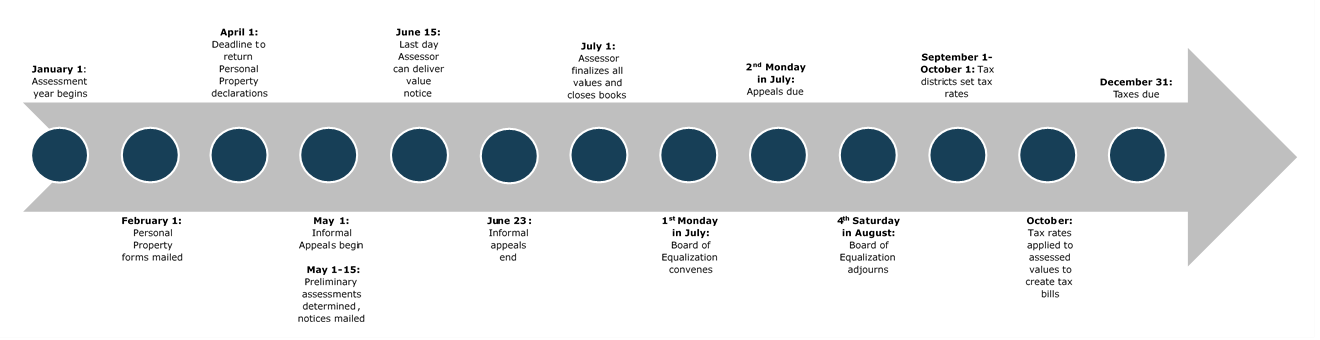

. The Personal Property Department collects taxes on all motorized vehicles boats recreational vehicles motorcycles and business property. To determine how much you owe divide the property X Assessment Rate 33 13 by the estimated market. The value of your personal property is assessed.

October 17th - 2nd Half Real Estate and Personal Property Taxes are due. Louis County is 223800 per year based on a median home value of 17930000 and a median. Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty.

03340 per 100 Assessed Valuation. Louis County collects on average 125 of a propertys. November 15th - 2nd Half Manufactured Home Taxes are.

Yearly median tax in St. Louis County is 2150 per 100 of assessed value. November 15th - 2nd Half Agricultural Property Taxes are due.

Account Number number 700280. Pay a Parking Ticket How to pay a parking. 03870 per 100 Assessed Valuation.

May 15th - 1st Half Agricultural Property Taxes are due. Louis County Missouri is 2238 per year for a home worth the median value of 179300. If the accepted payment is less than the.

Personal property is currently assessed at 33 of its value. Personal Property Tax Rate. Residential Real Property Tax Rate.

Ad Enter Any Address Receive a Comprehensive Property Report. To declare your personal property declare online by April 1st or download the printable forms. The median property tax in St.

November 15th - 2nd Half Manufactured Home Taxes are due. Louis County Auditors Tax Division accepts payments of more or less than the exact amount of a tax installment due for the current year. Louis County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax.

Louis County Commercial Real Estate has an. The median property tax in St. Louis County collects on.

Louis County collects on average 125 of a propertys. If you own any personal property in St. August 31st - 1st Half Manufactured Home Taxes are due.

Louis County you will need to pay your. The median property tax in St. Account Number or Address.

The tax rate for personal property tax in St. Louis County Missouri is 2238 per year for a home worth the median value of 179300.

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

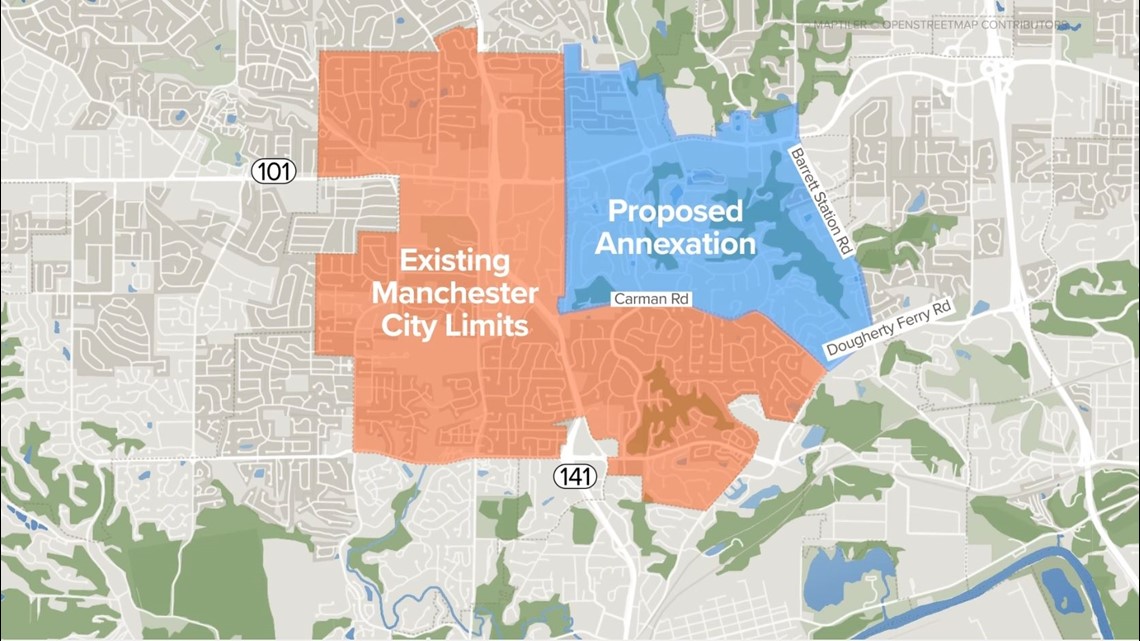

Manchester Seeks To Annex Unincorporated St Louis County Ksdk Com

Revenue St Louis County Website

Action Plan For Walking And Biking St Louis County Website

Print Tax Receipts St Louis County Website

Online Payments And Forms St Louis County Website

County Assessor St Louis County Website

County Assessor St Louis County Website

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Collector Of Revenue Faqs St Louis County Website

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More